Nasdaq Worst Drop Since 2022

Nasdaq Worst Drop Since 2022

Stock Marketplace Plunges: Nasdaq Suffers Worst Day on the grounds that 2022, Dow Drops 1,000 Points Amid Heavy promote-Off

March eleven, 2025

The inventory market experienced a pointy decline on Monday, with the Nasdaq Composite recording its worst day due to the fact that 2022 and the Dow Jones business average plummeted over 1,000 factors. The large-based total promote-off was brought about by rising bond yields, concerns over Federal Reserve policy, and growing international economic uncertainty.

Nasdaq’s Worst Decline in Years

The Nasdaq Composite fell over 4%, marking its biggest single-day drop due to the fact that 2022. The steep decline changed into driven with the aid of major losses in the era zone, with shares of Apple, Microsoft, Tesla, and Nvidia all suffering double-digit percent declines.

traders reacted negatively to the modern-day economic information, which confirmed signs of continual inflation. better-than-expected inflation numbers fueled fears that the Federal Reserve may hold hobby charges extended for an extended length, placing pressure on high-growth tech shares.

Dow Jones Plummets Over 1,000 points

The Dow Jones business common (DJIA) dropped 1,000 factors, wiping out recent gains and pushing the index into bad territory for the month. buyers dumped shares across more than one sector, with banking, retail, and industrial shares also seeing heavy promotion pressure.

The S&P 500 is no longer spared both, declining nearly 3.5%, marking its worst consultation in months. The benchmark index, which tracks the performance of 500 of the biggest U.S. groups, fell under key technical levels, triggering similar panic amongst buyers.

What triggered the sell-off?

several key factors contributed to the surprising marketplace downturn:

rising bond yields: the ten-month U.S. Treasury yield spiked to its maximum stage in over 12 months, attaining 4.5%. higher bond yields make shares much less appealing, especially for high-increase groups that rely upon reasonably priced borrowing for gasoline expansion.

Federal Reserve price Uncertainty: traders are worried that the Federal Reserve may additionally delay hobby rate cuts due to chronic inflation. current facts caution that inflation remains above the Fed’s 2% goal, lowering the chance of a close-to-time period fee reduction.

weak corporate income: numerous main corporations have issued disappointing income reports and lowered their forecasts for the coming months. This has raised issues that monetary increases can be slowing faster than anticipated.

Geopolitical Tensions: Ongoing tensions within the Middle East and concerns over worldwide exchange disruptions have in addition fueled market uncertainty, causing main traders to shift in the direction of more secure assets like gold and authorities bonds.

Tech stocks Hit hardest

generation stocks bore the brunt of Monday’s promote-off, with a number of the biggest names in the sector seeing billions wiped off their marketplace value:

Apple (AAPL): Dropped five 2% as concerns over slowing iPhone sales in China persevered.

Microsoft (MSFT): Fell 4.8%, in spite of a strong boom in its cloud computing enterprise.

Tesla (TSLA) plunged 6.5%, extending its recent losses amid worries over declining electric vehicle demand.

Nvidia (NVDA): Dropped 7.1% as investors locked in income after a strong rally in advance this 12 months.

marketplace Analysts React

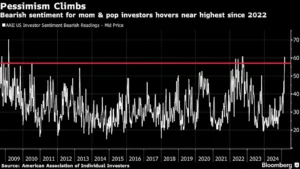

marketplace specialists defined the sell-off as a response to both economic basics and investor psychology.

“That is a classic case of the marketplace reassessing danger,” stated David Solomon, CEO of a chief funding firm. “Investors have been pricing in fee cuts too aggressively, and now they are understanding that inflation is more continual than expected.”

Others warned that extra volatility could be ahead.

“If the Federal Reserve alerts that fees will remain excessive for longer, we should see further disadvantage pressure on shares,” said Lisa Gomez, a senior market strategist. “The bond market is flashing warning signs, and investors ought to be cautious.”

safe-haven assets gained

at the same time as shares took success, gold, and bonds surged as traders sought safer investments.

Gold charges rose 2.3%, reaching a six-month excessive.

The U.S. dollar was reinforced as international investors sought safe haven in cash.

government bonds noticed a heavy call for, with the ten- to 12-month Treasury yield retreating barely after an initial spike.

What’s next for the marketplace?

investors at the moment are looking ahead to key economic reviews and Federal Reserve statements in the coming weeks.

the following inflation document will be closely watched to see if charges are cooling.

The Fed’s upcoming assembly should offer readability on whether price cuts are nevertheless viable later this year.

corporate earnings reviews from foremost firms will indicate whether agencies are feeling the impact of higher prices.

end

Monday’s 1,000-point drop inside the Dow Jones and Nasdaq’s worst day in view that 2022 has dispatched shockwaves via the marketplace, reminding investors of the risks related to monetary uncertainty. even as some analysts see this as a brief correction, others warn that similar declines could be ahead if inflation stays stubbornly excessive and hobby costs stay multiplied.

For now, investors can be watching the Federal Reserve and monetary records closely, as the subsequent movements within the inventory marketplace rely upon whether inflation cools or keeps pressure on the economy.

Source: NBC news