Nifty

Nifty

Should Sensex and Clever Financial Backers Be Worried about a Potential US Downturn? Master Bits of Knowledge for India

As worldwide monetary vulnerabilities loom, worries about a possible downturn in the US are causing swells in monetary business sectors around the world. Indian financial backers, especially those with stakes in Sensex and Clever, are quick to comprehend what these advancements could mean for their portfolios. Specialists say something regarding whether Indian business sectors are ready for disturbance and what financial backers ought to consider in the midst of these worldwide monetary worries.

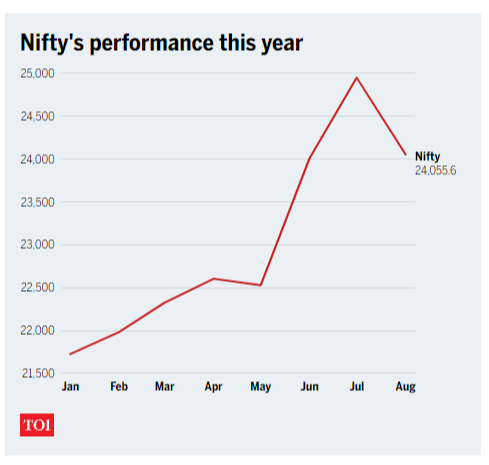

The Ongoing Business Sector Situation

As of late, the Indian securities exchange encountered a huge slump, raising caution among financial backers. The Sensex and Clever records saw significant drops, mirroring the uneasiness over the expected monetary lull. This decline comes when worldwide business sectors are anxious because of different international strains, inflationary tensions, and inventory network interruptions.

US Downturn Fears

The anxiety toward a downturn in the US originates from different elements, including increasing financing costs by the Central bank to battle expansion, continuous production network issues, and international struggles. These components have prompted a careful viewpoint of the worldwide economy. Since the US assumes a critical part of the planet’s economy, a downturn there could have broad results.

Influence on Indian Business sectors

India, being a developing business sector, isn’t invulnerable to these worldwide patterns. The interconnectivity of monetary business sectors implies that a critical decline in the US economy can impact financial backer opinion and capital streams in India. Nonetheless, specialists propose that the effect probably won’t be basically as extreme as dreaded.

Well-qualified Feelings

Monetary examiners and market specialists have offered shifted points of view on the circumstance. Some accept that while transient unpredictability is unavoidable, the drawn-out essentials of the Indian economy stay solid. Here are a few vital experiences from specialists:

Momentary Instability versus Long Haul Development:

Specialists contend that the Indian securities exchange could confront transient unpredictability because of outer shocks, however, the drawn-out development story stays in salvageable shape. Factors like a powerful homegrown economy, good socioeconomics, and continuous changes could pad the effect of worldwide monetary slumps.

Area Explicit Effect:

Not all areas will be similarly impacted. Send-out arranged ventures could feel the squeeze more than those zeroed in on homegrown utilization. Areas like IT and drugs, which have huge openness to the US market, could confront more difficulties contrasted with others.

Enhanced Venture Approach:

Financial backers are encouraged to keep an expanded portfolio to moderate dangers. Broadening across areas and resource classes can help in dealing with the effect of market unpredictability. Specialists recommend zeroing in on great stock areas of strength and staying away from alarm selling.

Strategy Measures and Government Drives:

The Indian government and the Hold Bank of India (RBI) have devices available to them to oversee monetary dependability. Proactive strategy measures, financial boosts, and money-related facilitating can help in padding the effect of worldwide monetary shocks.

How Should Financial Backers Respond?

For Indian financial backers, the key is to stay educated and not settle on rushed choices in view of transient market developments. Here are some moves to consider:

Remain Informed: Stay up to date with worldwide and homegrown monetary turns of events. Understanding the macroeconomic climate can help in going with informed venture choices.

Center around Essentials: Put resources into organizations with solid asset reports, reliable income development, and great administration. Quality stocks will generally perform better over the long haul, in any event, during times of market unpredictability.

Keep away from Frenzy Selling: Market redresses are a characteristic piece of the speculation cycle. Stay away from the impulse to auction interests in a frenzy. All things being equal, think about the drawn-out development capability of your speculations.

Counsel Monetary Consultants: Look for guidance from monetary specialists to rethink your venture procedure and guarantee it lines up with your monetary objectives and changes resilience.

End

While worries about a potential US downturn and its effect on the Indian securities exchange are substantial, specialists accept that with a reasonable venture approach, financial backers can explore these vulnerabilities. By zeroing in on long-haul basics, broadening portfolios, and remaining informed, Sensex and Clever financial backers can relieve dangers and keep on accomplishing their monetary targets.

Source: Times of India

Also Read: India vs Sri Lanka 1st ODI: Secure Thrilling Win Against Sri Lanka in 1st ODI

2 thoughts on “Nifty”